"mazda616" (mazda616)

"mazda616" (mazda616)

07/31/2016 at 14:59 ē Filed to: Car Payment

2

2

29

29

"mazda616" (mazda616)

"mazda616" (mazda616)

07/31/2016 at 14:59 ē Filed to: Car Payment |  2 2

|  29 29 |

August 10 marks ten months since I bought my 2016 Mazda6. My payment on my 72 month loan (yeah, yeah, I know) is $296.79. Right now, I pay an extra $3.21 to make it $300.00 even. My interest rate is 2.99%.

My principal balance on the car right now is $17,479.54. Multiplying that by my interest rate makes $18,002.18. Divide that by $300.00, and 60 months from now, Iíll have it paid off.

If I bump my monthly up to $400.00, that 60 month number changes to 45. Wow!

I think Iíll start paying $400.00. I originally planned on making double payments but that hasnít worked out.

This was definitely a learning experience for me. Remember that before you comment smart ass stuff, please. I did get the car for $100.00 over invoice, got $5,500.00 for my trade-in, and put $1,000.00 down.

At least I love the car, and Iím not upside down on it. Itís got around 9,700 miles on it now, so (even with my trip to Florida and back at the end of May), Iím averaging less than 1,000 miles per month.

And, aside from the 6 and our home, my wife and I are debt free. No credit card debt or personal loan debt and our CX-5 is paid off as well. It was paid off in 2013, actually.

We could definitely be doing worse.

LongbowMkII

> mazda616

LongbowMkII

> mazda616

07/31/2016 at 15:02 |

|

That sounds reasonable.

ViperGuy21

> mazda616

ViperGuy21

> mazda616

07/31/2016 at 15:02 |

|

Love the car and the color! Congrats!

jvirgs drives a Subaru

> mazda616

jvirgs drives a Subaru

> mazda616

07/31/2016 at 15:04 |

|

god...that blue looks so good in the sun.

mazda616

> jvirgs drives a Subaru

mazda616

> jvirgs drives a Subaru

07/31/2016 at 15:12 |

|

Thank you. I love it as well. Mazda calls it ďDeep Crystal Blue.Ē

mazda616

> LongbowMkII

mazda616

> LongbowMkII

07/31/2016 at 15:13 |

|

I think so, too!

My wife sells Jamberry fingernail wraps online and easily makes $100.00 a month, so that'll go towards the extra $100.00 we are going to pay.

mazda616

> ViperGuy21

mazda616

> ViperGuy21

07/31/2016 at 15:13 |

|

Thank you!

Phyrxes once again has a wagon!

> mazda616

Phyrxes once again has a wagon!

> mazda616

07/31/2016 at 15:20 |

|

I am debating between this blue and the red on my impending CX-5 purchase, it looks so much better than the dark blue on my Jetta.

Wobbles the Mind

> mazda616

Wobbles the Mind

> mazda616

07/31/2016 at 15:28 |

|

I donít mind how long someone finances for as long as the interest rate is lower than whatís available for student loans (which are far worse than car loans). I will say that you shouldnít hesitate to place one large payment into the vehicle now rather than waiting until there is only $2,000 left on it and paying the entire thing then like most people do. By placing a large payment now ($1,000-$2,000) youíll save yourself a lot of interest and stay far ahead of any depreciation. Plus it will help out your debt-to-income ratio and bump up your credit score which will help your insurance premiums if you two are about renew anything.

Damn, I love looking at your car!

PS9

> mazda616

PS9

> mazda616

07/31/2016 at 15:29 |

|

There is no concept I despise more than that of car payments. Until I die, every car in my possession will be owned by me and no one else.

DipodomysDeserti

> mazda616

DipodomysDeserti

> mazda616

07/31/2016 at 15:35 |

|

Please tell me you have a tan leather interior with that beautiful blue paint.

Rico

> mazda616

Rico

> mazda616

07/31/2016 at 15:50 |

|

$300 a month with about $6500 down seems like a great deal on a car as nice as the Mazda 6. I know some people here will look at that monthly payment and cringe but I live in a city where a 1 bedroom apartment is $1200 a month so your car is a bargain!

Good luck with your payments and the car pretty soon it'll be paid off and you'll be looking for the 2020 Mazda 6 lol

E90M3

> mazda616

E90M3

> mazda616

07/31/2016 at 15:53 |

|

Multiplying that by my interest rate makes $18,002.18.

I donít think thatís how compounding interest works. Because finance isnít my area of expertise, we wonít use the formula for compounding interest. Assuming youíve made the first 10 payments and you owe 62 months at 296.79 youíd owe 18400.98 only making the minimum payments. However, if you make more than the minimum payment like you plan to itíll eat into the principal and youíll actually get it paid off faster than you think. For example, the loan on my M3 was $567.64 for 60 months, which works out to a total of $34058.40 if I made only the minimum payments cause of interest. I paid it off in 13 months and paid a total of $31290.00, and saved all that money on interest because I was making more than the minimum and it ate into the principal.

mazda616

> PS9

mazda616

> PS9

07/31/2016 at 16:14 |

|

That's a good philosophy to have. But, when you want a new car and can get a good interest rate and don't have a lot of other debt, it's not too bad.

mazda616

> Phyrxes once again has a wagon!

mazda616

> Phyrxes once again has a wagon!

07/31/2016 at 16:15 |

|

I wanted Soul Red Metallic but the dealer only had one 6 in that color and it was a Grand Touring model with the tech package - way out of my price range.

mazda616

> E90M3

mazda616

> E90M3

07/31/2016 at 16:16 |

|

So, I could pay it off even sooner, then. Interesting!

E90M3

> mazda616

E90M3

> mazda616

07/31/2016 at 16:21 |

|

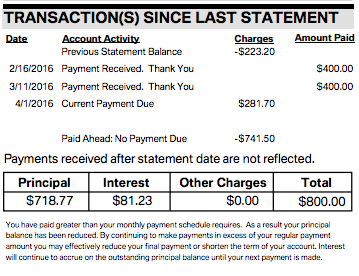

Yup, any more than the min payment goes straight toward paying down principal. For example hereís what it looked like when I made more than the min payment on my 1 series. Iíd show it for my M3, but I didnít have online payment for that.

Phyrxes once again has a wagon!

> mazda616

Phyrxes once again has a wagon!

> mazda616

07/31/2016 at 16:23 |

|

Since my purchase is on hold pending VW and the Feds playing nice I have some time. Fortunately the local Mazda dealer has three stores and a generally large inventory so they told me to check in after the court date when I have firm timeline and they will try to have the one I want sitting on the lot the day VW cuts me a check.

Iím looking at a Touring AWD, I donít need the AWD but apparently around here no one buys the FWD (only two FWD sitting on the lot). The sand interior is nonnegotiable, while the black hides spills its stupid hot in the summer, so it may come down to which exterior is available.

DasWauto

> mazda616

DasWauto

> mazda616

07/31/2016 at 16:26 |

|

Iíll try not to be a smart-ass but thatís not how compounding interest works.

The 2.9% rate is on a yearly basis but it is likely compounded (calculated) monthly, meaning that each month your remaining balance gets interest added to it at a rate of 2.9%/12= 0.2416%. with your current balance, around $45 of your monthly payment is covering that monthís interest. That cost will decrease over time as your balance decreases.

This is why it is beneficial to you to pay it off early (unless you can make more on your money than the interest rate youíre paying on the loan, but thatís a whole other discussion.)

mazda616

> Phyrxes once again has a wagon!

mazda616

> Phyrxes once again has a wagon!

07/31/2016 at 16:26 |

|

For what itís worth, our CX-5 is FWD and is still a beast in the snow.

That was with the OEM Yokohoma tires, too. It has Goodyears, now.

mazda616

> DasWauto

mazda616

> DasWauto

07/31/2016 at 16:27 |

|

I figured there was some interest math I wasnít doing correctly. I wasnít a finance major by any means. Either way, an extra $100.00 every month can't hurt.

DasWauto

> mazda616

DasWauto

> mazda616

07/31/2016 at 16:41 |

|

Me neither but I did take one finance class which covered stuff like this. Iíve found it useful.

The extra $100 will definitely help - rough guess but itíll probably save you about $300 in interest over the coarse of the loan and youíll be done paying 15 (ish) months earlier.

Dr. Zoidberg - RIP Oppo

> mazda616

Dr. Zoidberg - RIP Oppo

> mazda616

07/31/2016 at 16:55 |

|

Just reading this raising my heart rate. 400 a month would be just another heap on my pile of endless bills. I donít know how you all do it. But it would be nice to have a nice car.

Phyrxes once again has a wagon!

> mazda616

Phyrxes once again has a wagon!

> mazda616

07/31/2016 at 16:55 |

|

Good know, as a school teacher I generally donít need the AWD so Iíll ask and see if they can dig up a FWD as it gets closer to November but I think it will come down to color over FWD as I suspect all the FWDs will be white or black.

mazda616

> Dr. Zoidberg - RIP Oppo

mazda616

> Dr. Zoidberg - RIP Oppo

07/31/2016 at 18:39 |

|

We live in an area with an extremely low cost of living and my wife and I both make decent money for the area. We also don't pay a lot for other stuff.

random001

> mazda616

random001

> mazda616

07/31/2016 at 20:16 |

|

If you love the car and plan to keep it, a 72 month note isnít bad. With that low an interest rate, itís not bad. Yes, itís always better to have less, lower payment, etc. But this is life, it happens. Your best option is always to have the lowest possible payment, and pay more on it. That way if some month is really tight, you have the option to pay the lower amount. If that $100 can be better used elsewhere, or invested, then do that. Otherwise, go for it!

random001

> Dr. Zoidberg - RIP Oppo

random001

> Dr. Zoidberg - RIP Oppo

07/31/2016 at 20:16 |

|

Some of us are engineers with near 20 years of working under our belts?

Dr. Zoidberg - RIP Oppo

> random001

Dr. Zoidberg - RIP Oppo

> random001

07/31/2016 at 20:24 |

|

Mmm that doesnít seem too relevant, we have plenty of people on here that comfortably afford new(er) cars who do not have white-collar jobs.

mazda616

> random001

mazda616

> random001

07/31/2016 at 20:52 |

|

Thatís what I was thinking when I got the loan. A 60 month loan is standard and was doable, but the 72 month loan got the payment to where we could easily make a payment and a half (or more) if we had a good month, or just a payment by itself if we had a not so good month.

random001

> Dr. Zoidberg - RIP Oppo

random001

> Dr. Zoidberg - RIP Oppo

07/31/2016 at 21:06 |

|

I didnít say all of us. There are people I work with that have $800/Mo car payments. Itís all in what you want and can afford. But a lot of us have felt the pressure of pikes of bills, too, and are grateful that we could work our way past it. I hope that for you, and everyone.